Introduction to Reconciling Accounts in QuickBooks

- Understanding Account Reconciliation

- Definition and importance of reconciling accounts

- Benefits of maintaining accurate financial records in QuickBooks

- Navigating to Reconciliation

a. Accessing the Reconciliation Tool

- Logging into QuickBooks Online

- Navigating to the Banking or Accounting tab

- Selecting “Reconcile” under the specific account to be reconciled

b. Preparing for Reconciliation

- Gathering bank statements for the reconciliation period

- Ensuring all transactions are recorded and categorized in QuickBooks

Initiating the Reconciliation Process

- Entering Reconciliation Details

a. Selecting the Account and Statement Date

- Choosing the bank or credit card account for reconciliation

- Entering the statement end date and beginning balance from the bank statement

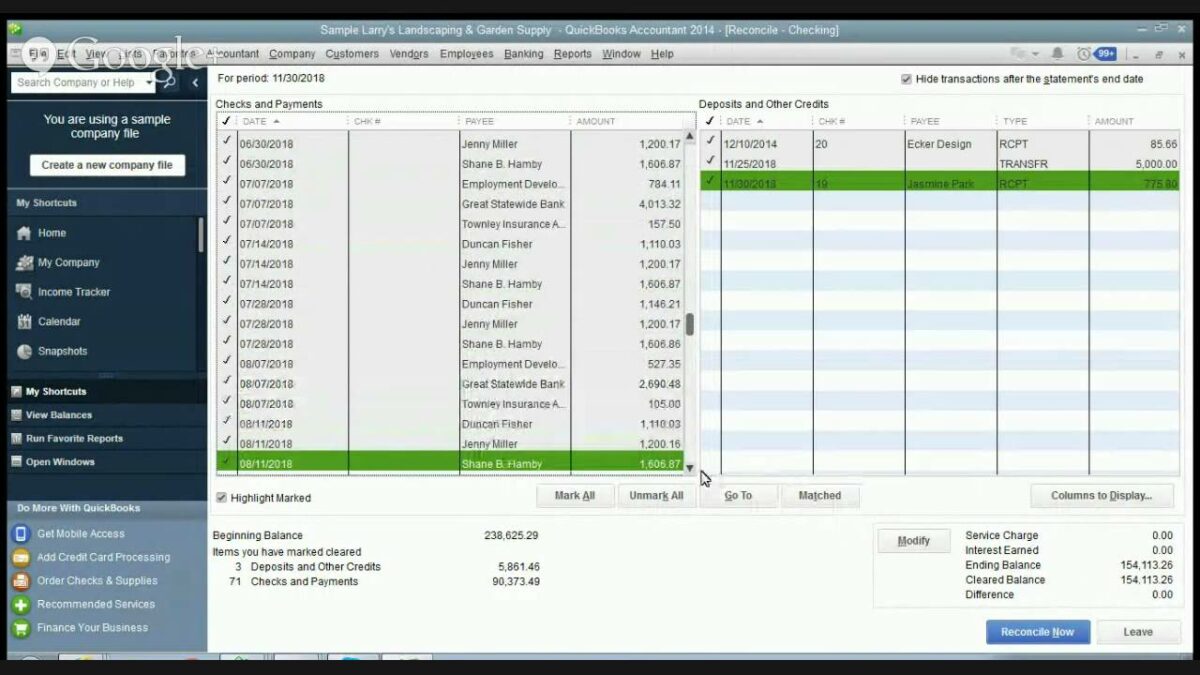

b. Verification of Transactions

- Reviewing transactions listed in QuickBooks against the bank statement

- Matching deposits, checks, and other transactions for accuracy and completeness

Reconciling Transactions

- Matching Transactions

a. Marking Transactions as Cleared

- Checking off transactions in QuickBooks that match those on the bank statement

- Ensuring reconciliation of both deposits and withdrawals accurately

b. Handling Discrepancies

- Investigating and resolving discrepancies between QuickBooks and the bank statement

- Addressing timing differences, bank fees, and outstanding checks or deposits

Reviewing Reconciliation Reports

- Generating Reconciliation Reports

a. Viewing Reconciliation Summary

- Generating reconciliation reports in QuickBooks

- Reviewing summary of reconciled and unreconciled transactions

b. Analyzing Discrepancies

- Analyzing reasons for unreconciled items or differences

- Addressing discrepancies and making adjustments as necessary

Completing the Reconciliation Process

- Finalizing Reconciliation

a. Reconciliation Completion

- Marking reconciliation as completed in QuickBooks

- Saving reconciliation reports and records for audit and reference purposes

b. Next Steps

- Reviewing post-reconciliation balances and reports

- Ensuring accuracy of financial statements and accounting records

Advanced Reconciliation Tips

- Advanced Techniques

a. Reconciling Multiple Accounts

- Managing reconciliation for multiple bank accounts or credit cards

- Using batch reconciliation methods for efficiency

b. Reconciliation Automation

- Setting up recurring reconciliation schedules in QuickBooks

- Automating bank feeds and transaction imports for real-time reconciliation

Troubleshooting and Error Handling

- Common Issues and Solutions

a. Handling Unreconciled Transactions

- Identifying and resolving outstanding items or errors

- Reconciling adjustments and corrections in QuickBooks

b. Bank Reconciliation Discrepancies

- Troubleshooting issues such as duplicate transactions or timing mismatches

- Seeking support from QuickBooks customer service or accounting professionals

Conclusion

Reconciling accounts in QuickBooks is a critical process for ensuring financial accuracy and integrity in business operations. By following this detailed guide, users can effectively manage reconciliation tasks, resolve discrepancies, and maintain up-to-date financial records. QuickBooks Online provides robust tools and features to streamline the reconciliation process, empowering businesses to make informed financial decisions and comply with accounting standards.