Managing expenses in QuickBooks is essential for maintaining accurate financial records and tracking business expenditures effectively. Here’s a detailed guide on how to manage expenses in QuickBooks Online:

Introduction to Managing Expenses in QuickBooks

- Importance of Expense Management

- Understanding the significance of tracking and categorizing expenses

- Benefits of using QuickBooks Online for expense management

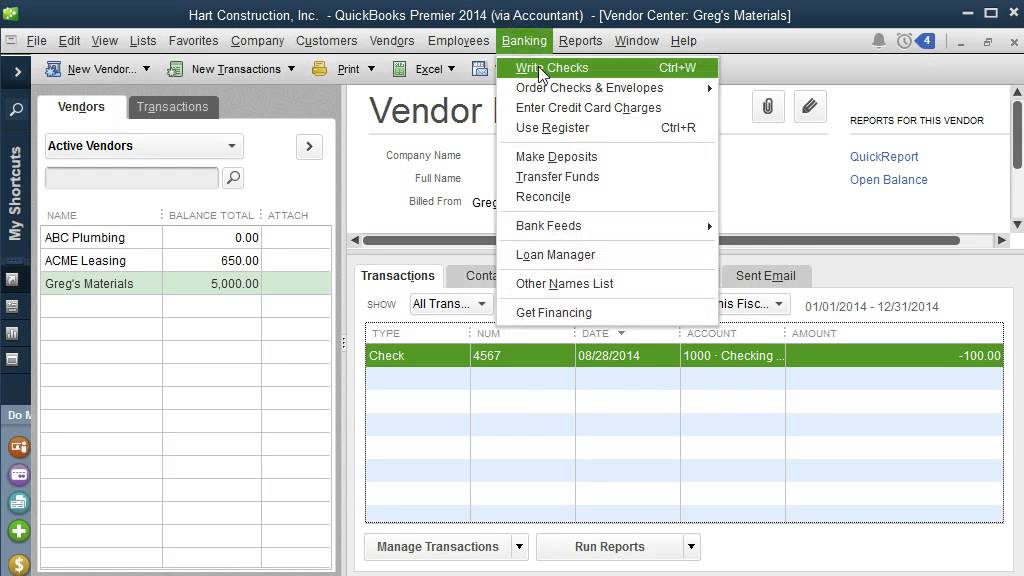

- Navigating to Expense Management

a. Accessing Expense Tools

- Logging into QuickBooks Online

- Navigating to the Expenses or Transactions tab

- Exploring features for entering, categorizing, and managing expenses

b. Setting Up Expense Categories

- Creating and customizing expense categories based on business needs

- Establishing default accounts and tax codes for expense transactions

Entering Expenses

- Adding New Expenses

a. Manual Entry

- Entering expenses manually into QuickBooks Online

- Inputting details such as date, payee, amount, and category

b. Importing Expenses

- Importing expenses from bank feeds or credit card statements

- Matching imported transactions with existing expense categories

Categorizing Expenses

- Expense Categorization

a. Assigning Categories

- Allocating expenses to predefined categories (e.g., office supplies, utilities)

- Ensuring consistency and accuracy in categorizing transactions

b. Splitting Transactions

- Splitting expenses across multiple categories if necessary

- Managing complex transactions with detailed allocation

Managing Vendor and Supplier Information

- Vendor Management

a. Adding Vendors

- Creating vendor profiles in QuickBooks Online

- Recording vendor details such as contact information and payment terms

b. Linking Expenses to Vendors

- Associating expenses with specific vendors for reporting and analysis

- Tracking vendor payments and managing accounts payable

Tracking and Reporting

- Expense Tracking

a. Monitoring Expense Status

- Tracking the status of entered expenses (e.g., paid, outstanding)

- Setting up reminders for overdue or upcoming payments

b. Generating Expense Reports

- Running expense reports in QuickBooks Online

- Analyzing spending patterns, trends, and budget adherence

Reimbursable Expenses

- Handling Reimbursable Expenses

a. Identifying Reimbursable Costs

- Tagging expenses as reimbursable to clients or employees

- Tracking reimbursed amounts and outstanding reimbursements

b. Reimbursement Tracking

- Recording reimbursements received or pending

- Reconciling reimbursable expenses with income and accounts receivable

Automating Expense Management

- Automation and Integration

a. Bank Feeds and Integration

- Automating expense imports from linked bank accounts and credit cards

- Streamlining data entry and reducing manual errors

b. Expense Rules and Templates

- Creating expense rules and templates for recurring transactions

- Automating expense categorization and allocation based on predefined criteria

Advanced Expense Management Tips

- Advanced Techniques

a. Project and Job Costing

- Allocating expenses to specific projects or jobs in QuickBooks Online

- Tracking project-related expenses for accurate cost management

b. Audit and Compliance

- Implementing audit trails and controls for expense transactions

- Ensuring compliance with financial regulations and internal policies

Conclusion

Managing expenses in QuickBooks Online is essential for businesses of all sizes to maintain financial transparency, streamline operations, and make informed decisions. By following this comprehensive guide, users can effectively enter, categorize, track, and report expenses within QuickBooks Online, enhancing financial management capabilities and optimizing business performance.