Running payroll in QuickBooks is crucial for businesses to accurately compensate employees, manage taxes, and maintain compliance with payroll regulations. Here’s a comprehensive guide on how to run payroll in QuickBooks Online:

Introduction to Running Payroll in QuickBooks

- Understanding Payroll Processing

- Importance of accurate payroll management

- Benefits of using QuickBooks Online for payroll processing

- Setting Up Payroll

a. Enabling Payroll Features

- Subscribing to QuickBooks Online Payroll services

- Choosing the appropriate payroll plan (e.g., Core, Premium, Elite)

b. Entering Employee Information

- Adding employee details (name, address, withholding allowances)

- Setting up direct deposit information or payment preferences

Initiating Payroll Processing

- Navigating to Payroll

a. Accessing Payroll Tools

- Logging into QuickBooks Online

- Navigating to the Payroll tab or Payroll Center

- Exploring features for running payroll, including employee setup and tax forms

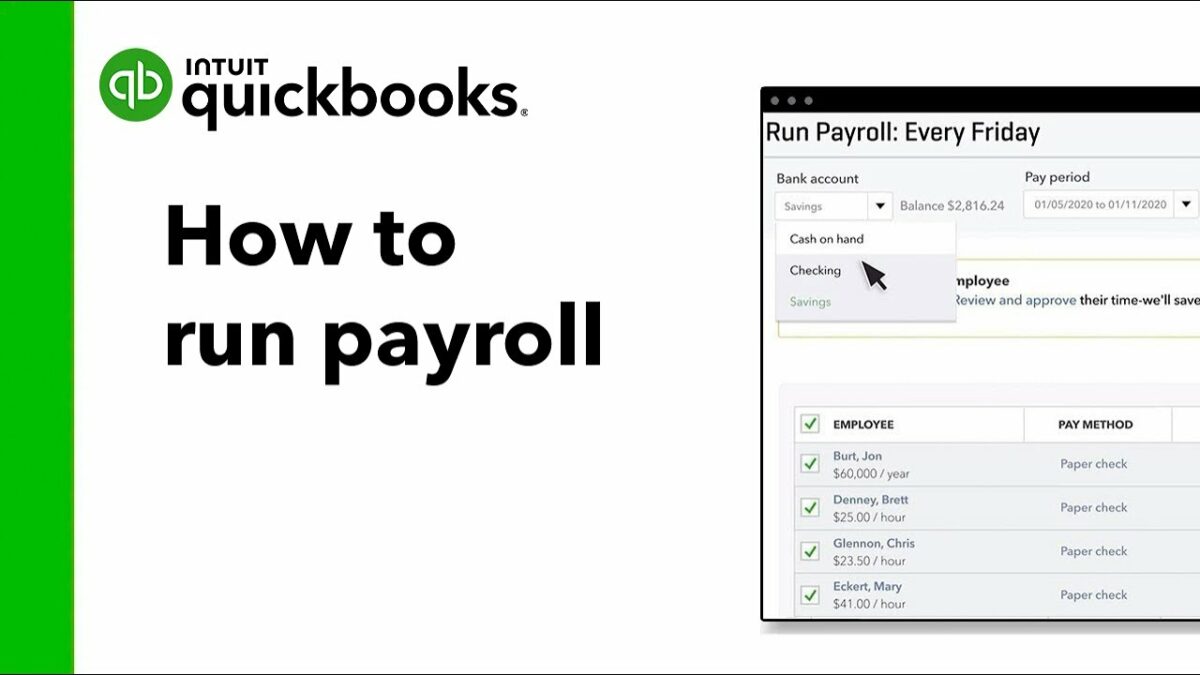

b. Selecting Payroll Schedule

- Choosing the frequency of payroll runs (e.g., weekly, bi-weekly, monthly)

- Setting up and managing payroll schedules for consistency

Processing Payroll

- Running Payroll

a. Entering Hours and Earnings

- Inputting hours worked or salaries for employees

- Adding overtime, bonuses, commissions, or other earnings

b. Calculating Deductions and Taxes

- Calculating federal, state, and local taxes based on employee details

- Withholding deductions for benefits, retirement plans, and other pre-tax items

Reviewing and Approving Payroll

- Reviewing Payroll Details

a. Previewing Payroll

- Reviewing payroll summary and employee payments

- Verifying accuracy of calculations and deductions

b. Making Adjustments

- Editing payroll entries for corrections or adjustments

- Addressing any discrepancies or errors before finalizing

Processing Payments

- Issuing Payroll Checks

a. Printing or Sending Paychecks

- Printing physical paychecks for distribution

- Sending direct deposits to employee bank accounts securely

b. Generating Pay Stubs

- Providing electronic pay stubs to employees

- Ensuring transparency and compliance with pay disclosure laws

Handling Payroll Taxes and Compliance

- Managing Taxes

a. Filing Tax Forms

- Generating and filing payroll tax forms (e.g., 941, W-2, W-4)

- Ensuring compliance with tax reporting and payment deadlines

b. Automating Tax Calculations

- Automating calculation and remittance of payroll taxes

- Tracking tax liabilities and payments within QuickBooks Online

Reporting and Record-Keeping

- Generating Payroll Reports

a. Running Payroll Reports

- Generating reports on payroll expenses, earnings, and deductions

- Analyzing payroll data for budgeting and financial planning

b. Maintaining Payroll Records

- Storing payroll records securely in QuickBooks Online

- Retaining records for auditing and compliance purposes

Advanced Payroll Features

- Advanced Techniques

a. Employee Benefits Management

- Managing employee benefits (e.g., health insurance, retirement plans)

- Tracking and reporting on benefit costs and contributions

b. Integration with Time Tracking

- Integrating time tracking systems with QuickBooks Online payroll

- Automating payroll calculations based on recorded hours

Conclusion

Running payroll in QuickBooks Online streamlines payroll processing, enhances accuracy, and ensures compliance with payroll regulations. By following this detailed guide, businesses can effectively manage employee compensation, taxes, and reporting within QuickBooks Online, facilitating smooth operations and financial management.