Introduction:

In the ever-evolving landscape of personal finance management, Microsoft Money has emerged as a robust tool designed to empower users in taking control of their financial destinies. From budgeting and expense tracking to investment management, Microsoft Money has played a pivotal role in helping individuals make informed financial decisions for decades. This comprehensive guide aims to explore the intricacies of Microsoft Money, providing users, both new and seasoned, with insights into its features, evolution, and practical applications. Whether you’re a novice seeking to enhance your financial literacy or an experienced user looking to unlock the full potential of Microsoft Money, this guide is your roadmap to financial empowerment.

Chapter 1: Understanding Microsoft Money

1.1. A Historical Overview: – Microsoft Money, originally introduced in the early 1990s, was developed as a personal finance management software solution. We’ll take a stroll through its history, highlighting key milestones and the evolution of features that have shaped its identity over the years.

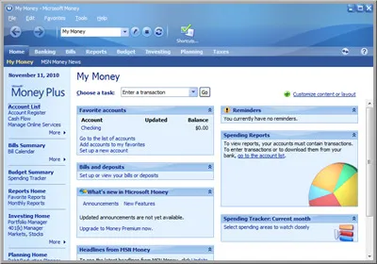

1.2. Purpose and Functionality: – At its core, Microsoft Money is designed to simplify the often complex task of managing personal finances. We’ll delve into its primary functionalities, exploring how it assists users in budgeting, tracking expenses, monitoring investments, and gaining a holistic view of their financial health.

Chapter 2: Features and Tools in Microsoft Money

2.1. Expense Tracking and Budgeting: – One of the foundational features of Microsoft Money is its ability to track expenses and create comprehensive budgets. We’ll explore how users can categorize expenses, set budgetary limits, and gain insights into spending patterns to foster better financial habits.

2.2. Account Management: – Microsoft Money acts as a centralized hub for managing various financial accounts, including bank accounts, credit cards, and investment portfolios. We’ll discuss the tools available for account reconciliation, transaction categorization, and monitoring account balances in real-time.

Chapter 3: Investment Tracking and Portfolio Management

3.1. Monitoring Investment Performance: – For users with investment portfolios, Microsoft Money provides tools for tracking the performance of stocks, bonds, mutual funds, and other investment vehicles. We’ll explore how the software consolidates investment data, offering a comprehensive overview of portfolio growth.

3.2. Asset Allocation and Diversification: – Effective asset allocation and diversification are crucial for a well-balanced investment strategy. We’ll discuss how Microsoft Money aids users in understanding their asset allocations, diversifying investments, and making informed decisions to optimize their investment portfolios.

Chapter 4: Net Worth Tracking and Financial Snapshot

4.1. Calculating Net Worth: – Microsoft Money allows users to calculate and track their net worth by aggregating assets and liabilities. We’ll explore how this feature provides a holistic snapshot of an individual’s financial standing, facilitating a deeper understanding of overall financial health.

4.2. Customizable Financial Reports: – Users can generate customizable financial reports in Microsoft Money, ranging from income statements to cash flow analyses. We’ll delve into the reporting capabilities of the software, showcasing how these reports offer insights into financial trends and patterns.

Chapter 5: Banking and Online Services Integration

5.1. Streamlining Banking Processes: – Microsoft Money integrates with various banking institutions, enabling users to streamline processes such as online banking, bill payments, and transaction downloads. We’ll discuss how this integration enhances efficiency and accuracy in financial management.

5.2. Security and Data Protection: – Security is paramount in financial management software. We’ll explore the measures Microsoft Money employs to safeguard user data, from encryption protocols to secure connections with financial institutions, ensuring a secure and protected financial environment.

Chapter 6: Evolution and Versions of Microsoft Money

6.1. Versions Over the Years: – Microsoft Money has undergone multiple iterations, each introducing new features and enhancements. We’ll provide an overview of key versions, discussing the evolution of the software and how each version has addressed the changing needs of users.

6.2. Discontinuation and Transition: – Despite its popularity, Microsoft Money was officially discontinued in 2009. We’ll explore the reasons behind this decision, as well as how users have navigated the transition to alternative financial management tools in the years following its discontinuation.

Chapter 7: Alternatives to Microsoft Money

7.1. Modern Financial Management Apps: – In the absence of Microsoft Money, several alternative financial management apps have emerged to fill the void. We’ll discuss popular alternatives, such as Mint, Quicken, and Personal Capital, comparing their features and functionality to help users make informed choices.

7.2. Considerations for Transition: – For users considering a transition from Microsoft Money to alternative platforms, we’ll provide guidance on the key considerations, data migration processes, and factors to evaluate when selecting a new financial management tool.

Chapter 8: Tips and Best Practices for Effective Use

8.1. Setting Up and Customizing: – We’ll offer step-by-step guidance on setting up Microsoft Money, including creating accounts, customizing categories, and configuring preferences to align with individual financial goals and preferences.

8.2. Regular Maintenance and Updates: – Like any software, Microsoft Money benefits from regular maintenance and updates. We’ll discuss best practices for keeping the software up-to-date, resolving common issues, and ensuring a smooth and reliable user experience.

Chapter 9: Overcoming Common Challenges and Troubleshooting

9.1. Data Import and Migration Issues: – Users transitioning to Microsoft Money or encountering data import challenges will find solutions in this chapter. We’ll address common issues related to data migration, ensuring a seamless transfer of financial information into the software.

9.2. Software Compatibility Concerns: – As technology evolves, users may face compatibility concerns with older versions of Microsoft Money. We’ll provide troubleshooting tips for overcoming compatibility issues, ensuring continued usability and functionality.

Chapter 10: Future Prospects and Community Support

10.1. Community Forums and Support: – Despite its discontinuation, a vibrant community of Microsoft Money users persists. We’ll explore community forums, support groups, and online resources where users can seek assistance, share experiences, and stay informed about updates or alternatives.

10.2. Potential Revival or Open-Source Initiatives: – There have been discussions about potential revivals or open-source initiatives related to Microsoft Money. We’ll delve into the prospects of such endeavors, examining the feasibility and implications for users interested in the software’s resurgence.

Chapter 11: Case Studies and User Experiences

11.1. Success Stories with Microsoft Money: – We’ll showcase case studies and success stories from users who have leveraged Microsoft Money to achieve their financial goals. These real-world examples will offer insights into how the software has positively impacted the financial journeys of individuals and families.

11.2. Challenges Overcome Through Microsoft Money: – Users have encountered and overcome various financial challenges with the assistance of Microsoft Money. We’ll explore specific scenarios where the software played a crucial role in helping individuals navigate financial obstacles and achieve stability.

Chapter 12: The Future of Personal Finance Management

12.1. Trends in Personal Finance Technology: – The landscape of personal finance management continues to evolve. We’ll explore emerging trends in personal finance technology, discussing how innovations such as artificial intelligence, blockchain, and mobile applications are shaping the future of financial management.

12.2. The Role of Microsoft Money in Retrospect: – Reflecting on its legacy, we’ll discuss the enduring impact of Microsoft Money on the personal finance management landscape. Whether as a pioneering force or a stepping stone to modern solutions, Microsoft Money’s influence persists in the narratives of financial empowerment.

Conclusion:

Microsoft Money, a trailblazer in personal finance management, has left an indelible mark on the journey toward financial empowerment. This comprehensive guide has navigated through its history, features, evolution, and practical applications, providing users with a roadmap to harness the full potential of this software. Whether you’re an enthusiast exploring the legacy of Microsoft Money or a user seeking guidance on effective utilization, may this guide empower you on your financial journey. Here’s to navigating finances with precision and embracing the ever-evolving world of personal finance management.